🧠 TODAY’S TOP MOVE

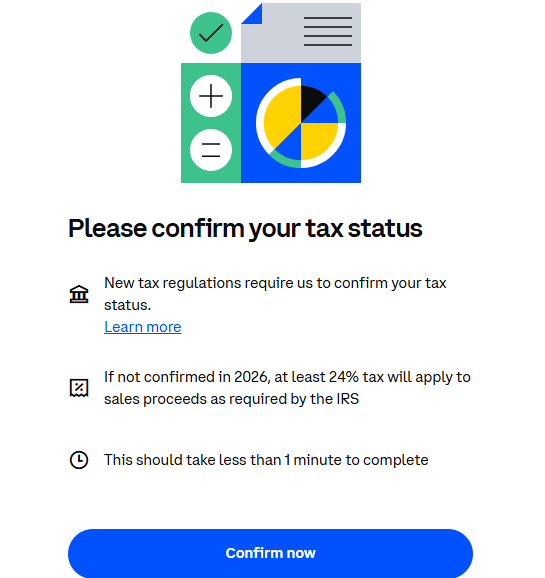

Coinbase just dropped a bomb: starting in 2026, crypto investors face 24% IRS backup withholding if they don’t confirm their tax status.

Translation: the IRS is watching — and taxable crypto just became a compliance nightmare.

👉 Screenshot proof: Coinbase’s investor notice (2025)

🗞️ THE SIGNAL

Here’s what Coinbase is warning every crypto holder in taxable accounts:

Confirm or else: fail to confirm your tax status, and 24% of every sale gets withheld.

Complex reporting: every trade tracked, every gain/loss logged.

Annual IRS headaches: endless forms, audits, and mistakes waiting to happen.

Most investors still don’t realize the simple fix:

💡 Crypto inside a 401(k) = tax-sheltered growth.

No capital gains.

No annual reporting.

No withholding.

Just compounding until retirement.

📊 WHAT THIS MEANS FOR YOU

For 401(k) holders:

✅ The same Executive Order that opened doors to private equity and real estate also cracked the door for crypto.

⚠️ Don’t wait for the IRS to get tougher — the best defense is moving crypto into retirement accounts before 2026.

For advisors/fiduciaries:

✅ Clients will start asking: “Can I hold Bitcoin in my 401(k)?”

⚠️ Platforms offering crypto custody must be vetted now — transparency, security, and fees matter.

⚖️ FIDUCIARY FOCUS

Tax traps are now part of your fiduciary duty to explain.

Education is key: taxable vs tax-sheltered crypto isn’t a nuance, it’s a survival tactic.

Custody & compliance: who solves the reporting challenge first will dominate this new space.

Translation: this isn’t about hype — it’s about shielding participants from IRS overreach.

✅ THE BOTTOM LINE

Coinbase just made it clear: the IRS is tightening the screws. Taxable crypto is about to become painful.

The opportunity? Crypto inside 401(k)s — where growth compounds tax-deferred, free from withholding and IRS headaches.

⚖️ THE FINAL WORD

Wall Street and Washington will always chase your gains. The smartest move isn’t fighting the IRS — it’s stepping into the shelter before the storm hits.

~ Brian

⚡ WHAT’S NEXT

Over the coming weeks, we’ll reveal the platforms already building crypto 401(k) products — and the compliance hurdles fiduciaries need to watch before recommending them.

📈 Forward this to anyone holding crypto in a taxable account.

Their next tax season is about to get ugly.